- #Three steps of accounting process software

- #Three steps of accounting process trial

- #Three steps of accounting process series

Īpart from identifying errors, this step helps match revenue and expenses when accrual accounting is used. As every transaction is recorded as a credit or debit, this step requires ensuring that the total credit balance and debit balance are equal. The accounting cycle’s fifth step involves analyzing your worksheets to identify entries that need to be adjusted. Analyze the worksheet to identify errors. In the next step, you’ll investigate what went wrong.

#Three steps of accounting process trial

Regardless of the scenario, an unadjusted trial balance displays all your credits and debits in a table.

This step generally identifies anomalies, such as payments you may have thought were collected and invoices you thought were cleared but actually weren’t. If they don’t, something is either missing or misaligned. Such balances are then carried forward to the next step for testing and analysis.Ĭreating an unadjusted trial balance is crucial for a business, as it helps ensure that total debits equal total credits in your financial records. The trial balance gives you an idea of each account’s unadjusted balance. While earlier accounting cycle steps happen during the accounting period, you’ll calculate the unadjusted trial balance after the period ends and you’ve identified, recorded and posted all transactions. A cash account is by far the most crucial account in a general ledger, as it gives an idea of the cash available at any time. The general ledger breaks down the financial activities of different accounts so you can keep track of various company account finances. A general ledger is a critical aspect of accounting, serving as a master record of all financial transactions. Once transactions are recorded in journals, they are also posted to the general ledger. Be sure to record transactions throughout the accounting period instead of waiting until the end and struggling to find receipts and other relevant information. It doesn’t require multiple entries but instead gives a balance report.īookkeeping is essential for all transaction types. On the other hand, single-entry accounting is more like managing a checkbook. Cash accounting, on the other hand, involves looking for transactions whenever cash changes hands.ĭouble-entry accounting suggests recording every transaction as a credit or debit in separate journals to maintain a proper balance sheet, cash flow statement and income statement. For accrual accounting, you’ll identify financial transactions when they are incurred. Your accounting type and method determine when you identify expenses and income. Still, it’s essential for businesses to keep track of their expenses. Some companies use point-of-sale technology linked with their books, combining steps one and two.

#Three steps of accounting process software

The next step is to record your financial transactions as journal entries in your accounting software or ledger.

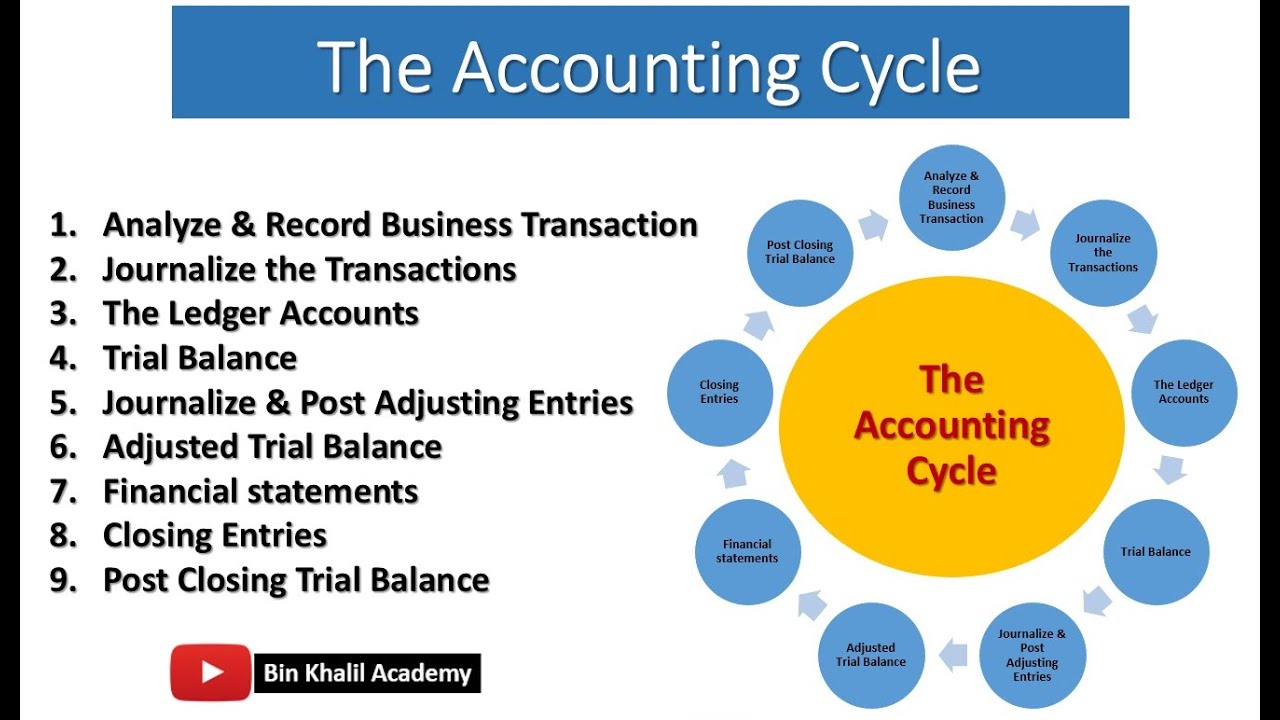

It’s like a checklist to complete when an accounting period ends.Ī business can conduct the accounting cycle monthly, quarterly or annually, based on how often the company needs financial reports.Ĭonsider using receipt-tracking software to organize transactions and expenses correctly. One of the accounting cycle’s main objectives is to ensure all the finances during the accounting period are accurately recorded and reflected in the statements. The cycle incorporates all the company’s accounts, including T-accounts, credits, debits, journal entries, financial statements and book closing. The accounting cycle is a holistic process that records a business’s transactions from start to finish, helping businesses stay organized and efficient. It serves as a clear guideline for accurately completing bookkeeping tasks. The accounting cycle breaks down a bookkeeper’s responsibilities into eight essential steps to identify, analyze and record financial information. The accounting cycle is a comprehensive process designed to make a company’s financial responsibilities easier for its owner, accountant or bookkeeper. Here’s an in-depth look at the accounting cycle, including the eight primary steps involved and how the best accounting software can automate this process. This systematic process is called the accounting cycle, and it helps make financial reporting easier and more straightforward for business owners.

#Three steps of accounting process series

When preparing financial statements, businesses perform a series of meticulous steps designed to convert basic financial data into cohesive, complete and accurate reports.

0 kommentar(er)

0 kommentar(er)